How to Ensure Sales Methodology Coverage Across Your Customer Lifecycle

In this post, I want to talk about how to ensure your sales methodology actually covers the entire customer lifecycle.

Why, you ask? Good question.

- It’s because I rarely see full coverage across the customer lifecycle. Most companies have gaps where salespeople or customer success wing it and do whatever they think is best based on their level of experience (which I call a “free-for-all” methodology).

- Companies with high levels of adoption of a formal sales process and sales methodology outperform the rest (by a significant margin).

Do we really need a better reason than that? I didn’t think so.

Introduction

If you hang on LinkedIn long enough you might start to think that selling is just about setting appointments and managing opportunities (or frankly, just discovery and maybe qualification).

I rarely see posts about negotiating or strategic account management (or any type of account management). I know it occurs because you can search the terms and find posts, but they are far less frequent topics in my feed.

Yet, if we only focus on parts of the customer lifecycle, we miss opportunities to provide best-practice guidance to our sellers at every stage. Missing this increases the free-for-all approach and reduces sales effectiveness.

So, what do we do? And how do we ensure methodology coverage across the full customer lifecycle? Let’s dig in.

Your Customer Lifecycle

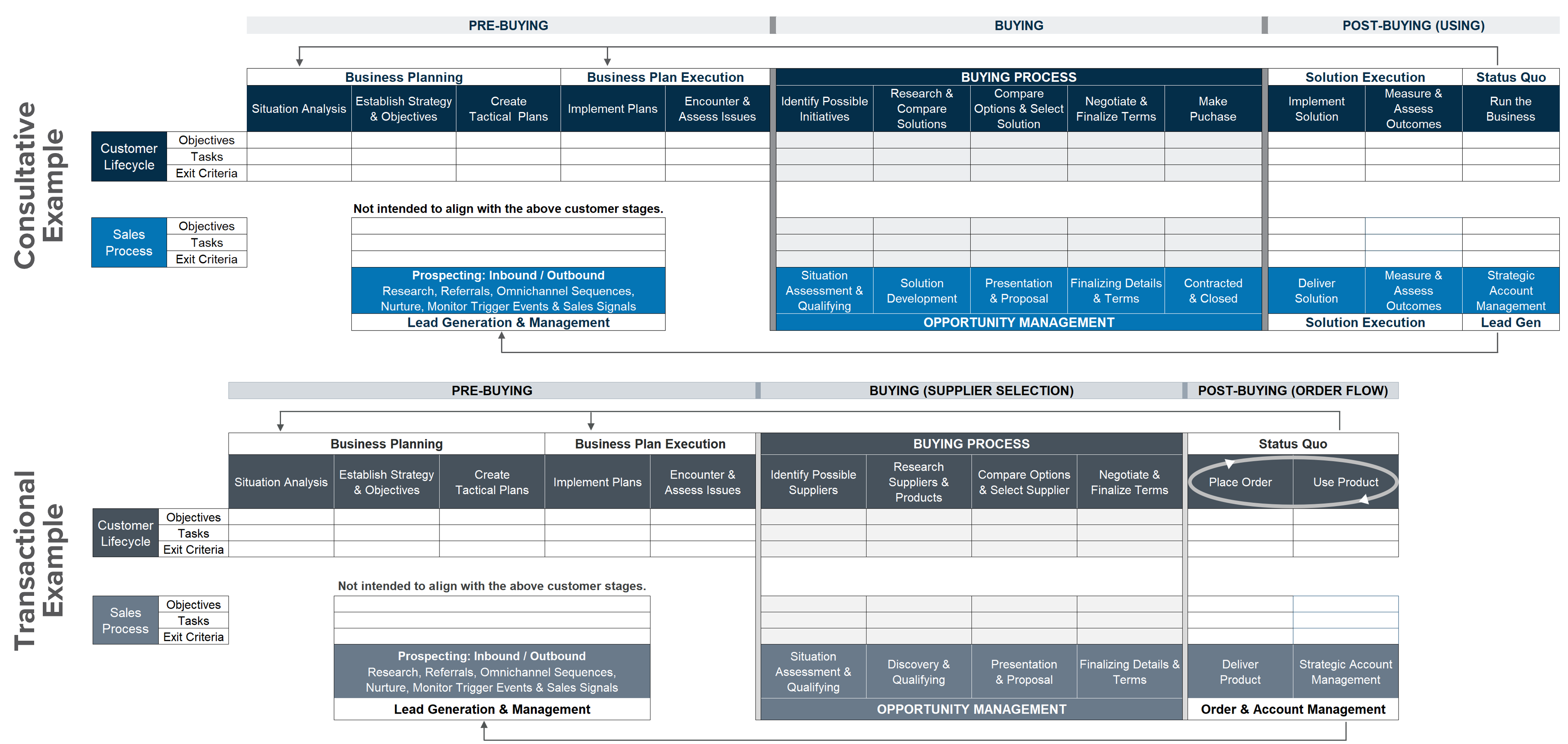

There are multiple ways to document your customer lifecycle. Here are two examples, with the lifecycle on top and the corresponding sales process aligned with it.

First, a disclaimer that these are just examples. They are realistic but may not reflect your customer lifecycle and their buying process, or your sales process.

In the above image, the top consultative example reflects a lifecycle for solutions that are purchased and implemented. The bottom transactional example reflects a lifecycle where the customer first selects a supplier, and then orders products, stocks them, uses or resells them, and reorders.

The customer lifecycles are subdivided into:

- Pre-Buying: This is where the customer is just running their business or maintaining their status quo. They do strategic and tactical planning and execute their plans. At some point, they may encounter issues or challenges that prevent success or hinder the achievement of their strategic objectives.

- Buying: When that happens, if the issues are serious enough, they begin to problem-solve and explore possible solutions. If they’re considering external solutions, they have entered a buying process. Even if they haven’t yet, they would likely be open to hearing about solutions that address the problems they’re experiencing. For the top example, this means seeking a solution. For the bottom one, it means seeking a supplier (or a new one).

- Post-Buying (Using or Order Flow): After making and implementing a solution, or selecting a new supplier, the company eventually returns to their status quo (or a new one): running their business (aka back to Pre-Buying).

- Note: This lifecycle is specific to your company and solution set. Other companies selling to this customer have independent lifecycles and sales processes. Within one customer, there may be multiple buying and sales processes occurring simultaneously or at different times than yours. HR may be exploring a new talent management system, finance a new travel management vendor, and operations a new ERP system. You get the picture.

The Corresponding Sales Process

- For the sales process, note that the Lead Generation and Management stage does not align to any specific customer lifecycle stage. This is because when a seller approaches a prospect, they may not know in advance where the prospect is in the lifecycle. It’s the seller’s job to try to learn that with pre-call research, but it’s not always possible. Unless it’s a public company, or you have seen some sort of trigger event or sales signal, or you have insider information, it can be difficult to assess this without contact. In that case, it’s the seller’s job to quickly assess, based on observation and conversation, where the customer is currently, so they can adapt.

- If it’s early in the Pre-Buying stages, before problems have become apparent or aggravating enough, you may need to use data, insights, research, experience or expertise, and case examples to educate about the problem and its seriousness, to generate interest. Or you may need to nurture for a while, until they are ready.

- If they are early in the Buying Process, you might be able to get involved before they reach out to others and either keep them from contacting competitors or shape their decision criteria. If it’s later-stage, you may need to insert yourself for consideration. In either case, you are navigating through their Buying Process and your Opportunity Management phases (including negotiating, which is often neglected).

- If they are in the Post-Buying stages and have already purchased an implementable solution, you can set yourself up to nurture to see if the solution produces the results they need. If they have selected a supplier, you may be able to position yourself as an alternative and eventually, through superior product quality or service, be able to unseat the incumbent.

- If they are in the Post-Buying stages and have selected your solution or selected your company as their supplier, you have to “stand and deliver,” as they say (or, rather, your implementation, customer success, warehouse team, or service team must deliver the value that was promised). Then, as a salesperson, you move into account management (or key account management or strategic account management, based on the size and importance of the account). In this case, you (or an account manager to whom you transition the customer) will analyze account potential, set a logical account objective, and develop actionable plans to achieve the objective and execute those plans over time.

Final Customer Lifecycle and Sales Process Thoughts

As mentioned earlier, the visuals may not represent your reality, but hopefully they’re good enough examples to make the point. You need to capture your own buyer’s journey and lifecycle, possibly for each product set. I say that because in some of my clients today, both of the above lifecycles apply (“buy, implement, use” and “select a supplier and purchase products as needed”).

Additionally, you’ll want to map out how leads are generated (inbound, outbound, and any other nuances for both) because the best practices for handling each may vary.

Once you have this, then you need to ensure that you have best practices, or top-performer practices captured for each stage, or that your chosen methodology (or methodologies) have it all covered.

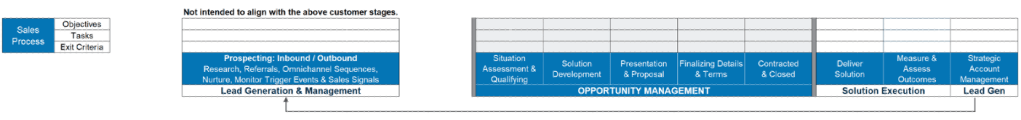

Every process has stages, stage names, objectives per stage, tasks to be completed, and exit criteria (things that must be completed to a predetermined level of satisfaction to move forward).

For sellers, the tasks include the things they do behind the scenes, the prep for buyer-facing tasks, and the buyer-facing tasks. The prep and buyer-facing tasks are the sales methodology. Not every behind-the-scenes task will be.

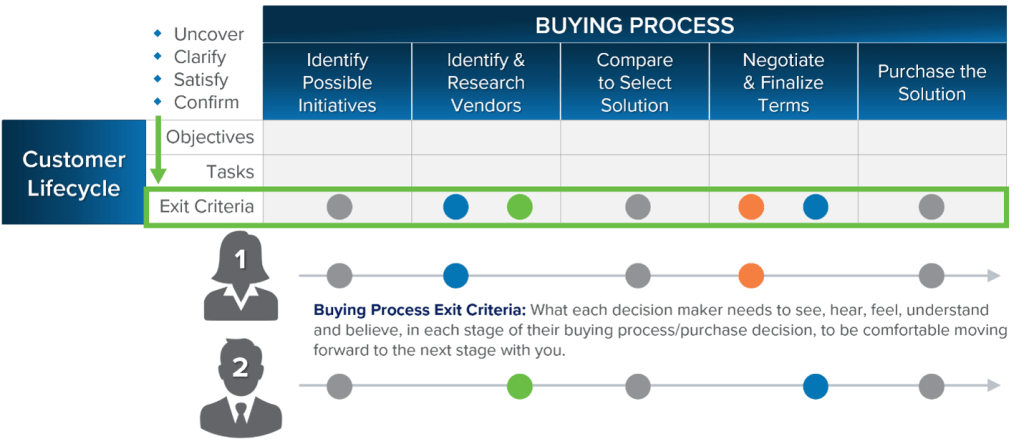

Sellers have their own set of exit criteria per stage, some of which are seller- or company-centric (qualification, for example), or ensuring a meeting is designed to meet both the seller’s objectives as well as the buyer’s. Yet, in addition to those Sales Process Exit Criteria, the sellers must also meet the Buying Process Exit Criteria for each decision maker, in each stage.

Sellers must uncover, clarify, satisfy, and confirm satisfaction of what each DM needs to see, hear, feel, understand and/or believe, in each stage, for them to be comfortable moving forward. Most sellers don’t manage exit criteria to this level, and it is a sticking point or friction that can stall opportunities and lose deals.

How to Ensure Full Sales Methodology Coverage?

If you’ve grasped the previous sections, this becomes much easier. As mentioned above, now you need to ensure that the best practices, or top-performer practices, are captured for each stage — or that your chosen methodology (or methodologies) have it all covered.

The one challenge I see frequently is that many commercial (for purchase) sales methodologies do not cover the entire customer lifecycle. If you use a commercial methodology, you often need to purchase multiple methodologies or design something internally to fill the gaps and get everything covered.

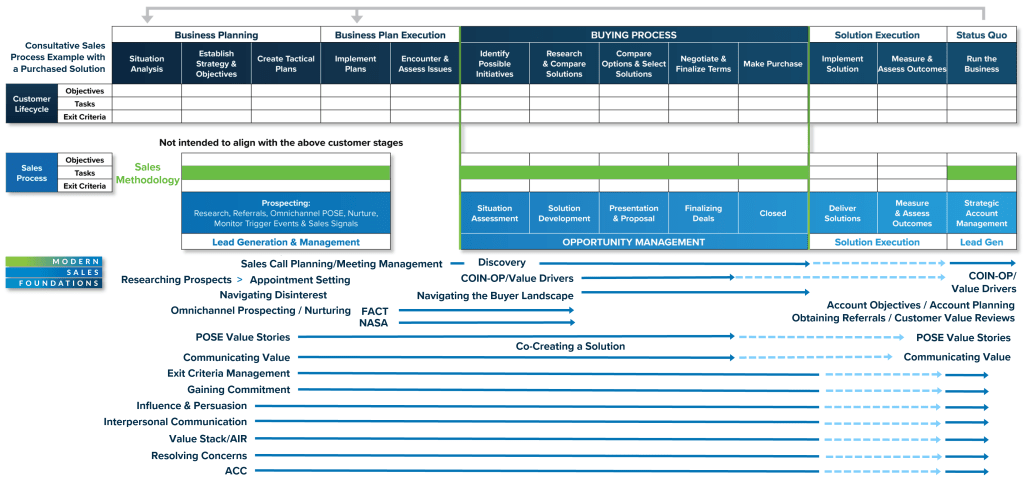

What We Did with MSF

With Modern Sales Foundations (MSF), this is why we chose to cover mindset and core buyer-centric principles, prospecting, opportunity management, and account management, in one program. We’ll gladly help clients select role-based curriculum paths, as needed, but we wanted to cover as much of the lifecycle as possible with one course.

That said, we did not, however, include negotiating, because that is an entirely different skill set than selling, and is covered in another program. Negotiating shouldn’t start until the sales job is done – at least until value has been established and accepted, and you’ve hit a concern that you can’t completely resolve. We cover negotiating skills separately in Negotiation Quotient 1.0 and 2.0 (Tactical and Collaborative Negotiation).

Separately, while you will build trust and sound relationships if you sell as guided to in MSF, purposefully and intentionally deepening customer relationships is a separate skillset as well, so we cover that separately (or more accurately, expand on it), in Relationship Quotient 1.0 and 2.0, built in collaboration with business relationship expert, Ed Wallace. It’s the same with Virtual Sales Mastery (this course is still free) or adapting to personality styles in Personality Quotient (another way of personalizing how you interact with your buyers and customers). All of these can be layered, but the bulk is covered by the core program, Modern Sales Foundations.

Build, Buy, Sew Together

For many years, I built everything internally – entire methodologies. I did it based on top-performer analysis, well-known and vetted best practices, my experience in sales, sales management, and as a sales consultant, and having conducted a number of top-performer analyses where I saw repeating patterns in top-performer behavior.

Then, I landed in a few roles where management didn’t have the tolerance for building methodologies internally, and I was forced to go to the market in search of appropriate commercial methodologies. I also read the books that most of these vendors published to become familiar with their approach. (Sidebar: not to steal or use their IP without paying for it – an unethical practice I still caution against.) At one point, I also had access to a service that reviewed methodologies, which was very helpful.

So, over the course of ten years or so, I became very familiar with most of the methodologies on the market, even those I didn’t purchase. I have had direct experience with programs from (in no particular order):

- Miller Heiman

- Learning International/AchieveGlobal

- Corporate Visions

- Wilson Learning

- Harvard Program on Negotiating (PoN)

- Action Selling

- Porter Henry

- RAIN Group

- Force Management (Command of the Message with MEDDICC)

- Franklin Covey

- Communispond (Socratic Selling)

- Dale Carnegie

- Funnel Clarity (when they were VorsightBP)

- …and a smattering of others from smaller vendors.

- I also worked for Richardson, became familiar with their offerings, and developed a program for them on insight selling (the original Selling With Insights).

I share this only because it’s relevant to my next point. Most of these are not a full-cycle methodologies. Although some of the vendors do offer multiple separate courses that you can sew together or use with different sales positions, based on what those positions are responsible for. If your goal, as I recommend, is to cover your entire customer lifecycle, then you need to plug the holes, one way or another.

You can only do this well if you have done the above work and identified everything your sellers need to do to perform at the highest possible level at every stage. Then it becomes fairly easy to layer your chosen methodology into your lifecycle, identify gaps, and work to close them. You can do that by purchasing another methodology (which can get expensive) or developing things internally to close the gaps.

Reinforcing it All Requires Sales Coaching Excellence

This post is about sales methodology coverage, but I’d be remiss if I didn’t at least mention that you won’t get full adoption and mastery of your methodology(ies) unless your managers know them as well or better than your sellers, and unless your frontline sales managers can assess performance, identify gaps, and train and coach to close those gaps.

Closing Thoughts

Ensuring sales methodology coverage across the customer lifecycle can be a challenge. At the same time, it’s also a necessity — especially if your desired outcome is a high-performing, best-in-class sales force. “Winging it” or “Free-for-all” methodology will not get you there. And neither will gaps or holes in your best practices.

By understanding your buyer’s journey, mapping your full customer lifecycle and sales processes, and addressing gaps with best practices or tailored methodologies supported by ongoing sales coaching, you can radically elevate your team’s effectiveness and outcomes.

If you’ve hung with me to this point, I’m curious to hear what you think. Let me know what resonated with you, what didn’t, or what strategies have worked in your organization — I’d enjoy hearing your thoughts and successes!

Want to see what full lifecycle coverage looks like in action?

Get access to 3 free episodes of Modern Sales Foundations and start equipping your team with the skills they need across the entire customer journey — from prospecting to account growth. Click here to unlock your free episodes.

This post was originally published as a LinkedIn newsletter, which you can find here.

Previous

Next