How to Adapt & Optimize Your Sales Methodology Based on Buyer Context

Today, we’re diving into a smarter way to sell: adapting and optimizing your sales approach based on the buyer’s context, not just your playbook. I’ve talked a lot about Adaptive Selling lately, and while this builds on that idea, you don’t have to go all-in on a new system to start seeing results. Small shifts based on buyer context can make a big difference.

Introduction

A good sales methodology can flex (especially if it’s built well). It’s not always intuitive for salespeople to do it, but it’s not that difficult and can be taught. We have implemented Modern Sales Foundations in both transactional and consultative selling environments and in both inside and field sales — and in fact, in the Distribution vertical, we often find companies who operate with both sales models — transactional flow business (buy, stock, use or resell, and restock) and bespoke or implementable solutions (buy, implement, use).

To do this topic justice, I’m going to do one deep dive on how our Situation Assessment Framework (used for discovery) can flex to three different scenarios. Then, I’ll point out several other frameworks and models that can flex, without the same level of deep detail. Hopefully, this will give you something to think about and dig into to get value from, while I demonstrate how you can adapt and optimize a sales methodology based on context.

Let’s get started.

The Situation Assessment Framework

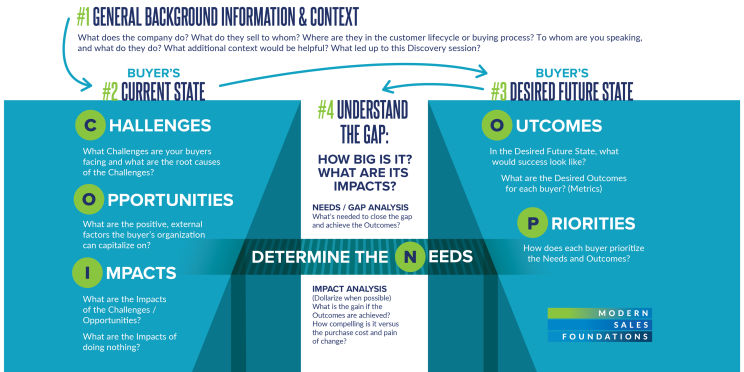

For the 3 scenarios I’ll present, it will be helpful to have a foundation in the Situation Assessment framework. To do this, we need to do a quick review of what we teach in Discovery. At first glance, there’s a lot here, but we’ll walk through it piece by piece. It’s really pretty simple.

General Background Information & Context

The first piece is understanding the general background information and context about the account or opportunity. See #1 in the above image. What does the company do? Who sells what to whom and how? Where are they in their customer lifecycle or buying process? To whom are you speaking and what do they do? And lastly, what additional context would be helpful to know, and what led up to this discovery session? This background will give you a lot of information to get started.

Buyer’s Current State

Next is detailing the buyer’s current state. See #2 in the above image. Here’s where COIN-OP starts to come in. What are the Challenges they’re facing and the root causes of those. What are the Opportunities that they might be able to capitalize on? What are the Impacts of these challenges and opportunities, especially the impact of doing nothing or the status quo (meaning, not addressing the Challenges or not capitalizing on the Opportunities)?

Buyer’s Desired Future State

Next, is the buyers desired future state. See #3 in the above image. What are the outcomes that they’re hoping for? What does success look like, and does it vary by decision maker? What are all of the desired outcomes, and then the priorities of those outcomes?

Understand the Gap

This allows you to understand the gap between the current state and the desired future state. See #4 in the above image. How big is it? What are the impacts of closing the gap? You can now do a Gap Analysis (sometimes referred to as a Needs Analysis). This helps you determine the needs, or what is required to close the gap between point A and point B. You can also dollarize the impacts with an Impact Analysis, especially if you achieve the desired outcomes and lessen the impacts in the current state. And, when compared to the cost of the solution, what is the ROI of that? This is the foundation for creating a compelling business case and ensuring that you have Need And Solution Alignment. while this is often taught separately, you can also begin to qualify the opportunity during a Situation Assessment. This is what we teach in MSF. Now, knowing this about the Situation Assessment Framework, let’s define our three scenarios and discuss how the seller would need to do discovery differently, while still using the framework.

THE SCENARIOS

Scenario 1

First up, in Scenario 1, we have a large, strategic, or key account. This could be a national account, key account, or just a large enterprise customer. In this scenario, we’re talking about a consultative sale that involves problem-solving, advice, and recommendations. It’s a complex sale, meaning you’re dealing with multiple decision-makers at the same time.

Along with that consultative sale, you’re looking at a custom, engineered solution that may be co-created with various experts. This might include engineers on the customer’s side, some of your vendors, and of course, your own internal experts. After it’s purchased, this solution will be implemented and used. In the videos in Modern Sales Foundations, this is the scenario depicted with AirCo Solutions, which sells high-quality air filtration solutions commercially. We use this example in the program, because it’s the most complex one, and it’s easier to scale down what we teach, and do it more simply, than it is to teach the simple version, and hope people can scale it up to more complex scenarios. I hope that makes sense, and I’m sure you can think of a few clients you’ve worked with who fit this scenario.

Scenario 2

Now let’s consider a second scenario. This is occurring in a branch office. In this case, it’s a transactional sale across the counter. There is a single decision maker involved, and they are choosing from off the shelf choices at the branch. These are pretty different scenarios, right? Let’s look at one more.

Scenario 3

Here is our third scenario. In this one, a company is considering you to be a supplier of products they regularly purchase, based on the products they need to run their business or resell to their customers. It is probably more consultative in the initial selection and will become more transactional when they start ordering supplies. It’s likely that there are multiple people involved in selecting a supplier, for what they need, but not a very large group, as in Scenario 1.

In some companies, all three of these scenarios exist. And there are other possible scenarios, as well. Hopefully, one or more of these is close enough to your world to resonate and make the point.

For now, here are all three scenarios, side by side:

Optimizing Your Sales Methodology Based on Buyer Context

Coming back to the point of this post, let’s explore how a seller could flex and optimize their discovery approach with the Situation Assessment Framework for each scenario.

The Situation Assessment Framework Meets Scenario 1

Let’s go back to scenario 1. Imagine you are creating a digital twin for a series of industrial high-capacity chemical pumps. You are working with technical experts from an industrial Internet of Things (IoT) systems partner, an edge computer/sensor vendor, mechanical and electrical engineers from partners, your company and the client, the plant management team, and the client’s COO and CFO. It’s a bespoke solution in the high six-figure range, possibly seven. There is a lot more at stake, and it requires a far more detailed understanding of the current and desired future states. This will require more time, more questions, “peeling the onion” to get to root causes, and taking purposeful steps to understand multiple perspectives.

You will still use the Situation Assessment with COIN-OP from above, but the details have now increased by a factor of 100 and the situation requires a partnered team of solution providers to serve a large buying committee. It’s also no longer a counter-conversation where you’ll remember everything easily, is it? You’ll need a system to capture what you learn, so you can review, absorb, analyze and share it effectively with others.??

Then, in addition to documenting the two states with COIN-OP, understanding the deep business and technical requirements, and co-creating a workable solution, there is a business case development with cost-benefit analysis. There’s also likely a prototype process with a pilot, pilot review and analysis – and eventually, if all goes well, an implementation phase with monitoring and maintenance.

This sales process will require:

- Deeper discovery skills (an extended Situation Assessment)

- Expert navigation of the buyer landscape

- Outstanding process management (satisfying buying process exit criteria for a large team of buyers)?

- Great call planning and sales meeting management?

- Strongqualification and Need And Solution Alignment (NASA) at every stage.

- You’ll need to build strong relationships?with a high degree of trust, as you co-create solutions with your client and a team of experts.

As a seller, you will need to be like an orchestra conductor (who occasionally also plays an instrument). You will be a facilitator. This all starts with a very strong and deep foundation in Discovery.

The Situation Assessment Framework Meets Scenario 2

Now let’s think through Scenario 2. A customer walks into a branch, inquiring about cordless impact wrenches. You sell various tools from Milwaukee, DeWalt and Ingersoll Rand. Some sellers might just offer the Milwaukee because of the current promotion and spiff on that unit, and because they know it’s a good tool. Or, someone like you who wants to provide real value might ask about:?

- The Type of Work: The work being performed (examples: automotive, heavy plant maintenance, construction projects, scaffolding, etc.).

- The Application: The way the tool will be used on the job (environment, projects, constant vs. intermittent, etc.)?

- Battery Requirements: Average length of use between charging times (could determine a recommendation for one tool over another, or the purchase of multiple batteries and chargers).

This type of discovery, which may still uncover challenges or opportunities, is primarily about requirements – meaning, the needs, outcomes, and priorities of COIN-OP. It will allow you to consider the needed power, breakaway torque, size, speed, chuck type required, battery requirements and other factors known to an expert, and then recommend the best options to your customer. During the discussion, you may even learn about the context of the current project(s) and uncover a need for other things you can provide – being a one-stop shop or preferred provider.

Do you see the power of that? Simple and transactional do not mean rushed or poorly done, do they? The Situation Assessment with COIN-OP, even done at a high-level for this type of sale, is a powerful differentiator and ensures Need And Solution Alignment (NASA). Plus, the expertise and guidance provided could certainly earn you preference as a supplier when something else arises. There are many positive possible outcomes that branch out from an outstanding customer experience.

Pretty cool, right? The big, complex consulting model for complex Situation Assessment, can flex to work with a completely different type of sale.

The Situation Assessment Framework Meets Scenario 3

Now let’s think through Scenario 3. In this scenario, there are more places where discovery will come into play.

- The first is the act of picking a supplier, which is this scenario.

- But after that, the second is each time someone from the company calls to order supplies that they will be reselling.

- And a third may be when they need a bespoke implementable solution for their own business.

For this example, I’ll stick to Picking a Supplier, since that’s how we first defined Scenario 3.

This application of the Situation Assessment will be more like Scenario 1 than 2, but perhaps less intense and somewhat less detailed. There are likely multiple decision makers, but usually fewer than Scenario 1.

The questions you ask to map out the Current/Desired Future State (with COIN-OP) will be around their needs, common SKUs they order, order volume and frequency, what’s working well currently and what’s not — why they are shopping for a new supplier — and perhaps prices they are currently paying, but to ensure a value sale versus a price war, it needs to be more about understanding the things that matter most to them. Quality products, fast response, having things in stock when needed, quick delivery, quality products, etc.

Rather than an open line of questioning, the way a consultant would do (like Scenario 1), the approach would be slightly more like Scenario 2, with a directive purpose. In addition to asking about what it’s like now (Current State with Challenges, Opportunities, and Impacts) and how they want it to be (Desired Future State with Outcomes and Priorities), you can use this chart to develop questions to ask based on your strengths.

Some Other Possible Flex Points

This is not an inclusive list, but in addition to the above, more detailed example, I promised I’d offer a few other quick examples of how a methodology can (or should) flex based on the context. Here are several.

Pre-call Research & Sales Call Planning

If you sell one low-investment product that can be used by every frontline sales manager in the world, or every business traveler, or every business owner, your pre-call research and sales call planning is probably very minimal or non-existent.

For the average B2B sale, with a large number of target accounts or contacts, we teach the 3×5 method, which means spend up to 5 minutes to try to find up to 3 things about the prospect that you can use to personalize your approach (especially trying to pinpoint a problem they may be experiencing that you solve).

If you sell a $1MM+ solution to senior executives that solves a highly complex business problem in a niche vertical and have a target list of only 100 accounts, you will likely do hours of pre-call research and planning and create an omnichannel, account-based selling approach that deeply personalizes based on your research.

Qualification

Not qualifying is a bad decision. But the level and depth of qualification, and when it starts, may vary based on what you sell to whom and how.

Many reps qualify out a bit too early or fast, in my opinion, and miss opportunities. I don’t ever recommend wasting your time or theirs, or going deep or going on forever without qualification, but if I get an inbound approach from a possible Coach who doesn’t quite have decision authority or funding, I wouldn’t kill it on the first call without exploring their interest and why the feel a solution is needed. Swimming upstream from a lower level interested party to get interest with decision makers can work. I might not sink a ton of time, resources, or energy into it upfront, but I wouldn’t necessarily toss it to the curb, either. I’d view it as a possible opportunity and nurture the contact/account, until I can confirm that we can swim upstream successfully or that it’s a waste of time (for now).

Having said that, if you are talking to a Champion or Financial Buyer who asks for a price and after you provide a range, says, “We would never in a million years be able to afford that right now,” you’re probably done. But even in that case, I might test reality (could be a negotiating ploy, especially that early) by defining the scope of the problem and the possible returns, in comparison to what you charge, before killing the opportunity completely.

Again, just some examples of how methodology can flex or situational fluency.

Co-creating a Solution

If you sell a non-customizable product that is manufactured (versus services), and there aren’t options to consider, your co-creation will be limited, but you can still ask questions to cement Need And Solution Alignment and help the buyer feel that your solution completely meets their needs.

If you sell a bespoke solution with many configurable options, you want to engage your client along the way to have they feel they are basically designing their solution (and when you’re done, feel ownership of it).

Account Planning

PCF-L Analysis and Setting Account Objectives for Key Accounts

Co-creating a Solution

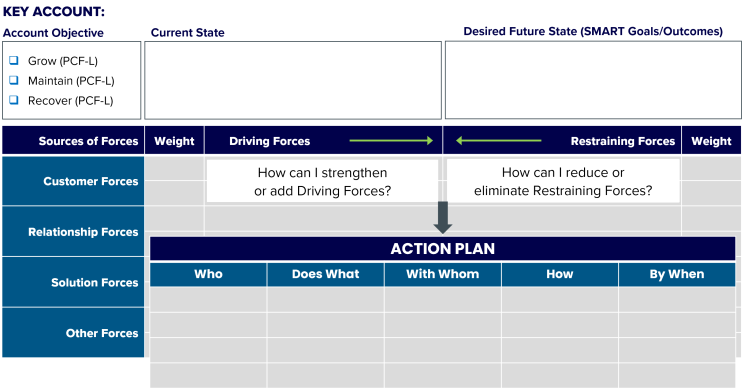

Imagine you are a key account manager with 25 accounts, all of which produce substantial revenue for the company. In this case, you will complete a PCF-L analysis (past production, current production, future production, and the knowing what you know, the likelihood of reaching that future level) for every single one of your accounts, to set appropriate account objectives for reach (grow – when there is potential, maintain – when there is not growth potential now but you don’t want to lose what you have), or recover – when production is slipping for some reason and you want to reverse it).

Based on this, you will complete a detailed Force Field Analysis and Account Plan for all 25 accounts, at least annually, and keep these updated as the year progresses.

Force Field Analysis and Account Planning for Key Accounts

As always, you conduct a Force Field Analysis and use it to create Account Plans. For these accounts, all of those plans should be well detailed, and updated over time, as progress is made.

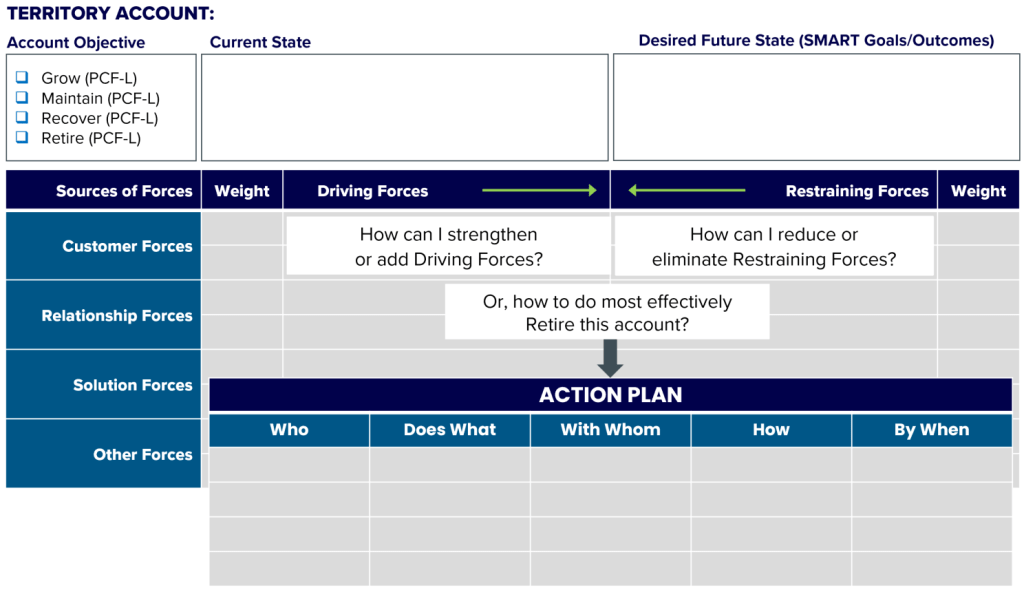

Now imagine you are an Account Manager with a territory of 200 accounts. It includes A, B, C, and D accounts. Some of the B, C, and D account have potential to become A accounts, but aren’t today. And some accounts have very little potential.

PCF-L Analysis and Setting Account Objectives for Territory Accounts

In this scenario, you’d do detailed PCF-L analysis and Force Field Analysis to create detailed Account Plans on your A accounts and the others you deem to have growth potential to become A accounts. Your effort, level of detail, and documentation will decrease as you move through the others, with the D accounts almost being done on the back of a napkin (humor, but not far off).

Force Field Analysis and Account Planning for Territory Accounts

As always you conduct a Force Field Analysis and use it to create Account Plans. For these accounts, however, the level of detail will vary widely based on whether it’s an A, B, C, or D account. They still should be updated over time, as progress is made, but the A accounts and those B-D accounts with significant growth potential should be more detailed, prioritized for action, and updated more frequently.

Closing Thoughts

I could go one, but hopefully I’ve made my point. Usually, Adaptive Selling is about adopting multiple methodologies and applying the right one based on the buyer’s situation. But as I’ve demonstrated here, a well-designed single methodology can also flex in multiple ways, based on the situation and circumstances.

This is part of what makes Modern Sales Foundations so effective. It has elements of consultative selling, value selling, and outcome selling built in, and the models and frameworks can be flexed to fit the circumstances. Which does make it somewhat adaptive, but because it’s a single methodology, also makes it far easier to gain adoption and foster mastery.

This post was originally published as a LinkedIn newsletter, which you can find here.

Previous

Next