How Does Your Sales Methodology Compare to What Top Performers Do Differently?

Today, I want to share some insights into what I learned from 16 years of conducting top-performer analysis, to allow you to compare how your sales methodology stacks up. To do that, I’m going to use my Modern Sales Foundations course as a yardstick to measure against, since it includes much of what I learned from those analyses.

Two Important Disclaimers

- This may seem “salesy” to some of you, since this is a course that we sell at SPARXiQ under our Modern Sales Foundations brand. I get it. And hey, if you’re interested in exploring MSF (I’ll abbreviate it as MSF for convenience), I wouldn’t be heartbroken. But the point of this post is to share what I learned and much of that is included in the course, so it’s my best example. And this is the written word – I won’t be twisting your arm and there’s no obligation on your part to do anything. So, take advantage of the knowledge, and worry less that I am somehow trying to hypnotize you into buying the course (“You are feeling very sleeeepyyyy….”). Fair? I hope so. Those of you who know me and follow my work will believe this. For the rest of you, “Trust me.” 😉

- Secondly, a very large portion of MSF is my intellectual property, based on the research in 12 different companies over a 16-year period. I had a sales methodology prior to joining SPARXiQ in December of 2018. But I co-authored this course with my former SPARXiQ colleague, Doug Wyatt. We massaged concepts together and Doug added a few of his own, based on his 10 years in sales, sales training, and sales enablement for a large chemical distributor. Doug is no longer with SPARXiQ, but I feel it’s fair to point out his contributions and I will try to do more of it as we proceed, as well.

Introduction

Top-Performer Analysis

Let’s start by defining Top-Performer Analysis (TPA).

Top-Performer Analysis is a study aimed at identifying the mindset, traits, knowledge, skills, and behaviors that distinguish top performers from other sales representatives.

TPA helps identify the similar and differentiating behaviors of the top sales performers. This can then be translated into what average performers (the middle) should continue doing, start doing or start doing differently, and what they should stop doing.

What is a Top Sales Performer?

A Top Sales Performer is a seller who has the right blend of the results, mindsets, traits, knowledge, skills, and behaviors that you want to replicate in your sales force. (Someone you would clone if you could.) They are highly successful on their merits vs. fortunate circumstances.

Very often, the top 4% (top 20% of the top 20%) are operating on fuel that average humans can’t run. They have the perfect DNA, an incredible will to sell and win, deep business acumen, force of personality (charisma, whether they’re an introvert, extrovert, or ambivert), and a skill set that is perfectly suited for sales. They are the Olympic athletes of the sales organization.

I have learned things that are replicable from the top 4%, but some of what they do is not easily trainable. Often, I’ve used them as a model for hiring, to try to find more like them. For skills, competencies, and behaviors, I have focused more on the 16% below them, or the rest of the top 20%. They tend to be the mere mortals who have figured out the magic sauce for sales success, that others can learn.

The Difference Between a Top Performer and a Top Producer

This article highlights the difference between a Top Sales Performer and what I call a Top Producer: Do You Know the Difference Between a Top Producer and a Top Performer?

In short, a top producer may be putting up the numbers, but it’s due in whole or part to a set of fortunate circumstances. This could be inheriting some great orphaned accounts, taking over a top performer’s territory, working with a sales manager who swoops in to take over and close major deals in their territory, or any combination of the above. By contrast, you could drop a true top performer into the middle of the Sahara Desert, and they would find a way to rebuild their territory.

In the above article, you may also be interested in the concept of a Hidden Top Performer, which is a salesperson who has the right stuff and is doing all the right things (and is doing well), but their success is limited by unfortunate circumstantial factors, in a similar way as a top producer’s performance is supported by fortunate circumstantial factors.

If you’d like to learn more about Top-Performer Analysis, download this deck: Top-Performer Analysis.

With that foundation, let’s segue into the review of topics in Modern Sales Foundations, and I’ll share some of the key differentiating behaviors of top performers, as we go. I’m not able to share every single differentiator in the program but will endeavor to call out ones that I have seen repeatedly in my Top-Performer Analysis work over the years.

Review of Top-Performer Practices in Modern Sales Foundations

As you progress through the four sections of the program, it’s worth noting that there is some cross-pollination of topics. Breaking these skills into sections is not an exact science. The course is designed for sellers to take all the modules, which teaches all the skills, but we recognize that doesn’t work for all roles. So, when teaching a subset of the course for a specific role, we always customize for the role, which may include mixing and matching modules across sections. Keep that in mind as you go through the below.

Also, I’ll describe each module but will attempt to highlight certain ones that are most impactful based on patterns I saw in the Top Performer Analyses.

CORE PRINCIPLES: Buyer-Centric Selling – The Key to Sustainable Success

The Core Principles section lays a foundation of mindsets and skills sets that are integral for buyer-centric/customer-centric selling. Even if a client wants to customize a path through MSF for a specific role (that doesn’t do everything in the course), we recommend that everyone complete this section.

THE MODULES & DIFFERENTIATORS

Introduction to MSF:

This module simply introduces buyer-centric selling and B2B buying research that indicates the need for it. There’s nothing skills-based or differentiating, other than to know that buyers are generally not happy with most sellers and if we want that to change, we need to change how we sell.

Aligning with the Buyer:

Here we teach NASA (Need And Solution Alignment), COIN-OP (Challenges, Opportunities, Impacts, Needs, Outcomes, and Priorities), and ACC (Acknowledge, Clarify, and Confirm). These are all about understanding your buyers and customers better than your competitors ever will. NASA ensures you are operating in your buyer’s best interest, which is how we define buyer-centric selling. COIN-OP is a framework for understanding their current state and desired future state (this reappears later in the Discovery module). ACC is an active listening/communication model that ensures your buyer feels deeply understood by you. All of these simple but powerful concepts were things I saw repeatedly in TPAs over the years.

The Value Stack:

Here we teach the concept of AIR (Awareness, Interest, and Relationship). The Value Stack is a reference to the fact that to proceed from stage to stage in their buying journey, buyers must see or feel enough AIR before they are willing to move forward. There are decision thresholds at every step of their buying journey, and the sellers must meet those thresholds. This is a great reminder, again, that it is all about the buyer, not just you or your sales process. I’ve used AIR for years and the concept that the seller must build AIR to meet the buyer’s next decision threshold, to be willing to move forward. But Doug coined the term Value Stack and came up with the visuals for it.

This is a great diagnostic to use when you sense resistance. Going one step deeper, the Interest portion of the Value Stack is further defined by 4 Value Drivers: Business, Experiential, Aspirational, and Personal. Almost every buyer has a primary Value Driver and often more than one lesser driver. This appears later in the Communicating Value module, where we stress learning to speak about solution in multiple ways, based on how your buyers each perceive “value.”

I had been using The Bain Value Pyramid, which is excellent and very detailed with 40-some elements. Doug took that and over the course of a weekend, simplified it to the four Value Drivers. I still like Bain’s work, but the four Value Drivers are far easier for the average sales rep to use.

Interpersonal Communication:

This surprised me by becoming a popular module. Not because it contains anything earth-shattering, but because it is a great reminder to use the interpersonal skills we have with purposeful intention. It’s the purposeful consistency from top performers that I saw in TPAs.

Influence & Persuasion:

We teach Aristotle’s Ethos, Pathos, and Logos here, or Credibility, Emotion, and Logic, as a persuasive model. Average sellers keep emotion out of their interactions. Top Performers purposefully bring it in.

Your Value Story:

Here we teach POSE for the first time (it reappears in Appointment Setting). POSE = Problem, Outcome, Solution, Explore and is a story format that starts from the buyer’s perspective with the problems they face (that you know you solve). This is an incredibly powerful model that came out of TPA and has made quite an impact for our clients. It works for prospecting and presenting.

Want to take it a step further? Weave in Ethos, Pathos, and Logos to your Value Story (especially emotion), and use the right Value Driver for the buyer. This is advanced, but this sort of “multilingual selling” and tailored value communication is what I saw Top Performers consistently doing far better than average.

Resolving Concerns:

Many reps handle concerns like Al Jaffee’s “Snappy Answers to Stupid Questions” from MAD Magazine: snarky, combative, tricky, or manipulative. We teach a buyer-centric communication model: ACCRC, which stands for Acknowledge, Clarify, Categorize, Respond, and Confirm. (If you’re paying attention, you can see ACC is built-in to this model. Acknowledge is all about empathy and the entire model is about demonstrating understanding.)

This focuses on understanding vs. being combative or tricky, and matching the right response to the type of concern. Of course, the more deeply that reps understand the concern, the better chance they have of resolving it. I have rarely seen this behavior and process used outside of the top 20% of sales reps, and it is a key differentiator. By the way, we refuse to use the word “objections” or “overcome” or the phrase “handle objections.” Do you know any buyers who want to be “overcome” or “handled?” No, you don’t. But once buyers feel deeply understood, helping them resolve their concerns is almost always welcomed.

PROSPECT DEVELOPMENT: Generate New Business Like a Top Performer

The Prospect Development section teaches the knowledge and skills needed for developing new business with modern buyers. As I tell managers when we prepare them to support the program, the content in this section is aimed at new business development and bringing in new logos, but much of it can also be used to further develop and grow current accounts. This can apply whether you are upselling, cross-selling, expanding, or trying to work your way into other divisions of the customer. Some of the things we teach in this section may also apply to Opportunity Management and Account Management.

THE MODULES & DIFFERENTIATORS

Customer Lifecycle:

Most reps don’t think about the overall customer lifecycle. Yet, if they can identify where the prospect is in their lifecycle, relative to the problems the rep can solve and the solutions they sell, reps can adapt their approach to meet the buyers where they are. If your buyer doesn’t recognize the seriousness of the problem, it requires a different approach than if they are already pursuing a solution or have just purchased one. Top Performers observe the cues and clues that tell them where the buyer is in the lifecycle and adapt accordingly.

Researching Prospects:

Research (and Sales Call Planning in the next section) is much talked about and not done frequently enough. Of course, the level of research may vary greatly based on several factors, and this is the first decision Top Performers make. Then they either spend up to 5 minutes seeking up to 3 facts they can use to personalize their approach, or they spend hours deep-diving for a critical executive-level approach in one of only 25 named accounts. But in either case, or somewhere in-between (it’s a sliding scale), they do the right amount of research to make a compelling approach.

Appointment Setting:

Problem-based prospecting is far more effective than product-based prospecting, and Top Performers know it. Using the POSE Value Story from section 1, Core Principles, and combined with what they learned from their research or their understanding of their ICP (Ideal Customer Profile) and Buyer Personas, Top Performers craft relevant and compelling POSE Value Stories, possibly infused with Ethos, Pathos, and Logos and/or relevant Value Drivers. Then, they deliver their story in an interactive way with checks and confirmations along the way, especially after P and O. They keep the Solution discussion a brief mention (this is not the time for a presentation or deep features and benefits) and simply ask the buyer if it makes sense to Explore further.

Top Performers also prepare and use POE for voicemails (leaving out Solution talk on a concise voicemail), as well as using omnichannel approaches (phone, voicemail, email, LinkedIn, drop-by, etc.). See Omnichannel Prospecting below for more.

Savvy Top Performers have more than one POSE Value Story ready, in case the first doesn’t resonate. If the second doesn’t resonate, they ask an open question about what issues the buyer is facing about X (the thing they can help with).

Navigating Disinterest:

Anyone who has ever prospected understands the level of both real and smokescreen/defensive statements buyers use, such as “I’m not interested” or its cousins, “We’re all set” or “We’re working with XYZ and aren’t interested in switching.” Our model and process for navigating disinterest is similar to what we taught in Resolving Concerns. This time, it’s ACERC or Acknowledge, Clarify, Explore, Recommend, Confirm. Top Performers know that they have a limited time before the window of opportunity shuts on their fingers, so they Acknowledge and Clarify quickly in one breath, asking why they’re not interested, using a multiple-choice question versus an open question.

“If there is no way for me to deliver value from your perspective, [Name], a lack of interest makes sense. I don’t want to waste your time, or mine. Just to ensure that we don’t miss a chance to help you get better results, may I ask why you don’t think you’re interested? Is this not a problem you need to address? Do you have other priorities? Or is it something else?”

You’ll learn quickly whether the buyer is putting up a smokescreen or has a legitimate reason for not being interested (or interested right now), and if they respond, you can walk through the rest of the model. It will usually end in one of three ways:

- You’ll move forward to have a discussion or set an appointment.

- The buyer will reconfirm their lack of interest and end the conversation.

- You’ll learn why this is not the right time and nurture the buyer over time until it is.

Omnichannel Prospecting:

As mentioned earlier, Top Performers prepare and approach buyers through multiple channels. One differentiating thing that Top Performers do is to connect the dots between channels. A voicemail using POE will mention an upcoming LinkedIn invite. The LinkedIn invite (where no selling is done) mentions an upcoming email with more detail. The email (a brief POSE Value Story perhaps with social proof and a relevant resource) mentions when you’ll call again. And so on.

Nurturing Prospects:

When buyers aren’t interested right now for a legitimate reason or are not responsive after several days of omnichannel approaches, Top Performers put them in nurture mode. They don’t “check in” or “just follow up,” but share information that is relevant for the buyer’s role and perhaps whatever they’re working on, with a mix of company and product info and other non-related items that the seller believes would be interesting or helpful for the buyer. “[Name], when we last spoke you mentioned you were working on XYZ. I saw this article in Harvard Business Review and thought you might find it helpful.”

Other Modules That Apply

All of the modules in Core Principles apply to prospecting or new business development.

OPPORTUNITY MANAGEMENT: Mastering the Sales Process – What the Best Do Differently

The Opportunity Management Section teaches the knowledge and skills needed to navigate the sales process successfully and win the opportunities you have generated. These are key sales skills that truly differentiate sellers from the average. Many of the things learned in this section also can apply to Account Management, and a few can apply to Prospect Development as well.

THE MODULES & DIFFERENTIATORS

The Buying Process:

This is a subset of Customer Lifecycle and there are two primary differentiators here.

- The fact that the seller is paying attention to the buyer’s journey, not just their sales process.

- That the seller recognizes that each decision maker has their own buying process exit criteria (BPEC), in each stage of their buying process, that needs to be satisfied before they are willing to move forward. You might recognize that this is a deeper extension of the Value Stack’s decision threshold, where the buyer must perceive enough AIR or Awareness, Interest, and Relationship (trust) to move forward.

Buying Process Exit Criteria is whatever a decision maker needs to see, hear, feel, understand, or believe in the current stage to move forward to the next. In some stages, all buyers may have the same exit criteria. In other stages, different buyers may have different exit criteria. This is why it’s called “The Complex Sale” when multiple decision makers are involved.

Top Performers recognize this and work to:

- Uncover each buyer’s exit criteria in each stage.

- Clarify to ensure they really understand it.

- Deliver what the buyer needs to feel satisfied.

- Confirm their satisfaction intentionally before trying to gain agreement to move forward.

Sales Call Planning:

Everyone seems to understand the importance of sales call planning, yet it is often ignored, downplayed, or done half-heartedly. Time and again, great sales call planning has proven to be a Top Performer differentiator. One of the deepest differentiators is to intentionally include the buyers’ objectives for the meeting, which syncs with the concept of Buying Process Exit Criteria, mentioned above. When the buyer feels like it’s their meeting as much as yours, and they see your focus on providing what matters to them to make a great decision, things get easier for you as the seller.

Sales Meeting Management:

An A plan bumbled is almost always beaten by a C plan executed flawlessly. This is the concept behind sales meeting management. With the plan in place, Top Performers act as an orchestra conductor, facilitating the meeting as planned. Some key differentiators include:

- Reviewing the plan and checking if anything has changed on your buyers’ side.

- Capturing at least key notes, even if recording or using AI transcriptions, so you can refer to them as needed.

- Keeping the meeting on time or when it’s clear it won’t be, calling it out and allow the buyers to decide the best course of action.

- Leaving time at the end to summarize, especially any decisions, remaining open topics, and any action plans.

- Remembering to HAM-BAM (Have A Meeting, Book A Meeting), to avoid the post-meeting scramble of trying to get the next meeting scheduled on everyone’s calendars.

Discovery (Situation Assessment):

The method we teach for discovery is the most compelling I’ve seen. It brings COIN-OP back from Section 1 and frames the Current State (Challenges, Opportunities, Impacts) versus Desired Future State (Outcomes and Priorities) with the Needs bridging the gap. When Top Performers do this, they do a Gap Analysis to determine the Needs or what is needed to close the gap between the two states, and an Impact Analysis to determine the ROI of making the move. To do this, they need to get the buyer to dollarize the impacts and outcomes. This creates a very compelling business case (or highlights that the problem isn’t big enough for them to tackle – both of which are good to know).

The questions that get asked are obviously around the problems that you solve, unless you are a management consultant with an almost unlimited number of things you can do to support your clients.

Discovery done this way is an incredible differentiator and very powerful. As my colleague Kurt Haug says, this framework operates on what he calls the Accordion Principle. In other words, it can flex down (or squeeze in) to support a simpler, more transactional sale, or flex up (or expand out) to support a highly complex and detailed sale. It’s a flexible model that Top Performers maximize to get the best possible results.

By the way, these Top Performers don’t float ideas or present solutions when using this situation assessment framework. They remain patient, build the framework out so that it’s compelling, and refer back to later when presenting or co-creating solutions. Average performers leap as soon as they see something they can sell. Top Performers lay back, waiting patiently, building the story, almost as if they are setting up bowling pins one by one, so that later they can knock them down.

Opportunity Qualification:

Sometimes it seems that there are more qualification models than there are automobiles. If it’s a good model, it almost doesn’t matter which you use, as long as you use it well. This is the difference with Top Performers. In MSF we teach that you must start by confirming you have NASA or Need And Solution Alignment – meaning, you know that you can solve their problems. Then we teach:

- F: Funding – meaning that the buyers have the means to purchase. Whether they have budget set aside, or can obtain the funding somehow, doesn’t matter. What matters is that you are speaking with decision makers (or at least one) who can commit the funds.

- A: Alternatives – meaning that you understand what else they may be considering. This could include competitors, DIY, or doing nothing and staying with the Status Quo.

- C: Committee – meaning that you are speaking with the right decision makers (buying committee) who can buy or make the purchase decision. This ties to Funding (able to commit the funds) but is broader, to cover the ability to make the purchase commitment.

- T: Timing – meaning that you can meet their timing needs, and whether there is some compelling event or timeline or sense of urgency for solving the problem, versus tire-kicking and dragging their feet. This is helped by having a good situation assessment in discovery, which compels them to make a change.

By the way, NASA is my IP, but FACT came from Doug. He has used this successfully in his past and we went with it, combined with NASA. My former qualification model was Decision Makers (Committee), Decision Criteria (NASA), Urgency (Timing), Outcomes (handled in discovery), Economics (Funding), and Options (Alternatives). You can see that everything in my model was handled somewhere, so the simplified NASA + FACT model was a good decision.

Again, regardless of your exact model, the most critical differentiator is using it. I’ve seen MEDDICC implemented with CRM scoring systems, and reps rating everything 4 or 5 on a scale of 1-5, and mostly it was B.S. When managers finally started peeling the onion and digging into the ratings and what was behind them, most of the ratings dropped to 1 or 2.

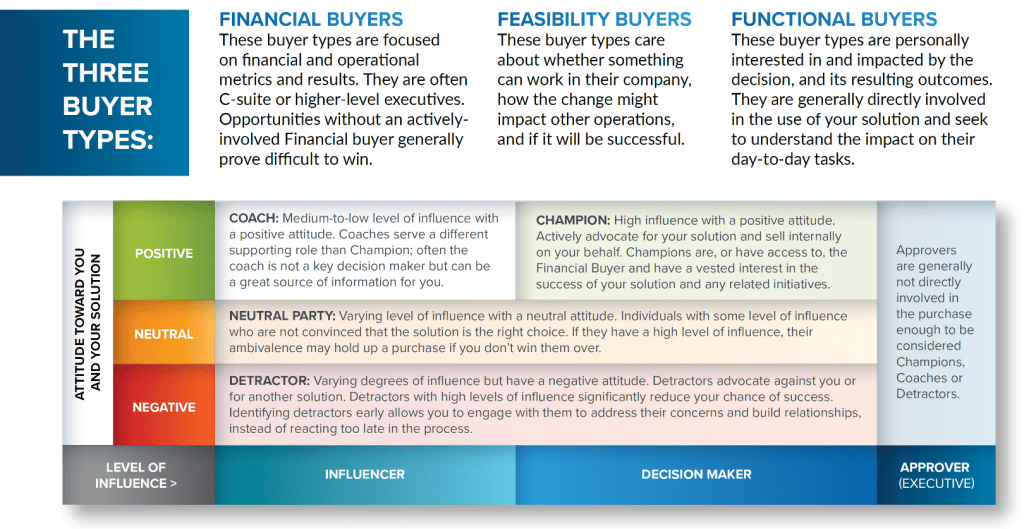

Navigating the Buyer Landscape:

This is the business version of Pin the Tail on the Donkey.

The matrix of level of influence and attitude toward you and your solution allows you to plot buyers or customers on the chart. This allows you to translate what you see into a tactical action plan to address any potential challenges, such as having a decision maker in the Neutral or Negative zone, or a bunch of Financial Buyers on the chart when you have only communicated about Experiential Value Drivers.

Top Performers map relationships and act accordingly. Others assume they know or do nothing.

Co-Creating a Solution:

Without getting into deep detail, whether it’s a simple transactional sale or a complex solution design process (the Accordion Principle again – it flexes), co-creating is about engaging your buyers in making choices and decisions along the way, so that the buyers feel a sense of ownership in the final solution. Top Performers do this. Others don’t – they might have NASA, and they may present to communicate problem/solution fit, but they rarely co-create.

Communicating Value:

Several things converge here. The first is an understanding that like beauty, value is in the eye of the beholder. It only matters what each buyer values, and if they see that value being produced by your solution. Many things come together here:

- Whether your buyers are Financial, Feasibility, or Functional buyers.

- The impacts they want to move away from and the outcomes they seek (Situation Assessment).

- Their Value Drivers (Business, Experiential, Aspirational, and/or Personal).

- What they liked about your POSE Value Story.

- The individual exit criteria in the current stage and what they need to move forward.

This brings us back to multilingual selling, being able to communicate in multiple ways about the same solution, based on what matters most to your buyers.

Top Performers excel at this. Average sellers do the same thing, the same way, each time, in each stage. And they always message the same way about the solution.

Gaining Commitment:

We don’t use the term “closing” because of all of the bad past methods and stereotypical closing techniques. Instead, we talk about gaining commitment. To do that, we recommend summarizing the buyer requirements, how you’ve met or exceeded them, confirming their acceptance, and then recommending a logical next step, and checking for their confirmation. Again, it’s mostly good, human, communication skills. If there are concerns, you can use the ACCRC model to resolve them, and gain agreement again. No magic formulas, no rolling the pen across the table, no Ben Franklin charts, no Puppy Dog closes. This works well for interim commitments (along the buying/sales process) as well as for final purchase commitments. (HAM-BAM is an example of an interim commitment, by the way — gaining commitment to book the next meeting before leaving the current one.)

Other Modules That Apply

- All of the modules in Core Principles apply to Opportunity Management

While not applied to prospecting specifically, most of the modules in the Prospect Development section can be helpful in Opportunity Management.

- The Buying Process is part of the larger Customer Lifecycle

- Researching applies to new decision makers who may enter the deal.

- While resolving concerns is more likely, you may need to navigate disinterest from time to time.

- Nurturing your individual buyers in various ways can support their journey through their buying and decision-making processes.

ACCOUNT MANAGEMENT: The Long Game – Account Management Excellence

The Account Management section teaches the knowledge and skills needed to purposefully and successfully manage your accounts, whether you are managing a territory, key accounts, or a few strategic accounts. It’s about analyzing potential, setting logical account objectives, and developing plans to achieve those objectives.

THE MODULES & DIFFERENTIATORS

Account Objectives:

It’s hard to hit a target you don’t see. Top Performers assess account potential using whatever metrics matter for the business. We teach PCF-L, which stands for Past account performance, Current account performance, best-possible Future account performance, and the Likelihood of achieving that rosy future, based on what you know today. Then, based on the analysis, the account objective would be Grow, Maintain (meaning to keep the business even though there is no growth potential), Recover (meaning to reinvigorate an account that has slowed or stopped doing business with you), or Retire (when it no longer makes sense to do business together). The fifth possible objective is Acquire, but that doesn’t pertain to current accounts.

Account Planning:

Like prospect research and sales call planning, Top Performers develop and maintain active account plans. We teach reps to use Force Field Analysis to assess the factors that are moving them toward the desired future state with the account (driving forces), and the restraining forces that are holding them back. Then, they develop plans to reduce or eliminate restraining forces and add or strengthen the driving forces.

Obtaining Referrals:

Consider these stats:

- 84% percent of B2B decision-makers start the buying process with a referral, and companies with referral programs report 71% higher conversion rates. (Source: Heinz/Influitive)

- 91% of customers would be willing to provide a referral to a company or brand they are satisfied with. However, only 11% of salespeople actually ask for referrals (Source: The Brevet Group)

It’s no surprise that I saw a statistically significant uptick in referral-seeking from the Top Performers in my TPA work.

Customer Value Reviews:

The difference in the number and quality of Customer Value Reviews (you may think of them as Quarterly Business Reviews or QBRs) from Top Performers in my analyses, was also significant. Top performers:

- Plan and conduct these meetings strategically.

- Get the right people there on both sides.

- Work to make their Champion and other decision makers the heroes of the story (and when possible, get THEM to present or report the value from the company’s perspective, in front of their bosses).

- Use these meetings to uncover or address any problems or issues, to increase satisfaction and foster loyalty.

- Explore growth opportunities.

- Ask for referrals.

The frequency of these meetings varies from monthly to quarterly to biannually, based on the size/importance of the account and its account objective, but Top Performers hold them and conduct them following the methods taught in Sales Call Planning and Sales Meeting Management, as well as adhering to their Account Plan. The meeting venue may vary from visiting the customer site, to inviting them (periodically) to the rep’s company HQ, to conducting the meeting over Zoom, Teams, Google Meet, or Cisco Telepresence – again, varying based on the size, importance, and objectives for the account.

Other Modules That Apply

- All of the modules in Core Principles apply to Account Management

While not originally presented for account management specifically, most of the modules in the Opportunity Management section and some in Prospect Development can apply to Account Management. That’s why there are only four modules in this section. It’s not that there isn’t more to managing accounts effectively, it’s just that the other concepts and skills have already been taught. For example:

- Sales Call Planning and Sales Meeting Management

- Conducting a Situation Assessment (from Discovery)

- Navigating the Buyer Landscape

- Co-creating Solutions

- Communicating Value (and being able to tell a POSE Value Story)

- Nurturing your key contacts (versus prospects)

And more.

A Note About Negotiating

If you negotiate price and/or terms, this is a critical skill that is often neglected in sales methodologies. We don’t teach it in the Modern Sales Foundations course itself because we believe it is a separate skill set and that selling should be completed before negotiations begin. If you don’t establish value before you negotiate, you will always give away more margin than you need to. (Savvy and better-trained B2B buyers get sellers to negotiate early and often). We do, however, have a separate two-part negotiation training program, Negotiation Quotient 1.0 and 2.0. NQ 1.0 focuses on tactical negotiation (I call it the “put your hand on your wallet” course) to teach sellers how to protect themselves. NQ 2.0 teaches integrative negotiation (think: collaborative, win-win, partnership).

Whatever programs you choose, don’t neglect training your sales force on professional negotiation. My one caution to you is to select something focused on B2B buying situations that teaches how to identify, defect, and redirect tactics or gambits toward a more collaborative, win-win, approach (often referred to as integrative negotiation). Negotiating hostage situations is not the same as a buyer-centric B2B selling environment, nor is using manipulative techniques from the 1980s. While some of these things are currently popular, it’s not the direction that I believe we should be taking our profession. Caveat emptor.

Closing Thoughts

How did you do? Or rather, if you’re in leadership or enablement, how are your sellers doing? Does your current methodology address all of these differentiators? Does it cover the full customer lifecycle? What are your sellers best at and where can they improve?

Higher levels of adoption of a formal sales process and sales methodology result in higher revenue plan attainment, higher rep quota attainment, and higher win rates.

CSO Insights

Since we know this from multiple sales research studies, it’s worth the attention and focus.

It’s also true that most methodologies only cover a portion of the customer lifecycle, leaving gaps where sellers do their own thing, rather than master best practices. All of which means there is opportunity for improvement – and better results.

In my experience, there’s a cumulative effect to these mindsets, skills, and behaviors, too. The more things you do well, and the more you demonstrate that you operate in your buyers’ best interest, the more trust and goodwill you build, and the more likely you are to survive a mistake and be forgiven, as well.

I hope it has been helpful to consider how your sales methodology compares to what top performers do differently.

Resources

Courses

Research

- The Fifth Annual Sales Enablement Study from CSO Insights (ungated; with the data cited in this newsletter)

- The Top-Performer Analysis Deck (ungated)

Past Related Newsletters

This post was originally published as a LinkedIn newsletter, which you can find here.

Previous

Next