Even if They’re Non-Linear, the Buying/Selling Processes Can be Managed

Today, I want to talk about managing the buying/selling processes. I especially want to address the notion that these processes are no longer linear. While there is some truth in that statement (and it has always been true, especially for the complex sale), it’s mostly that the buyers (decision makers and influencers) may not all be in the same stage at the same time, and that they may move backward as well as forward. A fact that is largely not managed by the average sales rep.

Let’s dig into this and I’ll explain what I mean.

Introduction

As we delve into this topic, it will help to keep two axioms in mind.

First:

The map is not the territory.

Alfred Korzybski

Meaning, things like maps and models (like process documentation) are representative of reality, but not reality. A map is a guide, but doesn’t show potholes, missing street grates, or where a child will run into the street chasing after a ball.

And second:

All models are wrong, but some are useful.

George Box

Similar to the above quote, in our case, a documented buyer’s journey or customer lifecycle and the corresponding sales processes, are a useful guide, but not 100% accurate 100% of the time.

As a semi-reformed perfectionist, these realities annoy me at times, but I have learned that if I get things 80% right, it delivers quite an impressive result.

The other thing to keep in mind, which keeps me coming back to process documentation despite the flaws or occasional inaccuracies, is this quote from Deming:

So, with that said, let’s dig into further to the linear/non-linear concept and how we can still manage processes effectively, despite complexity.

Customer Lifecycle and Sales Processes

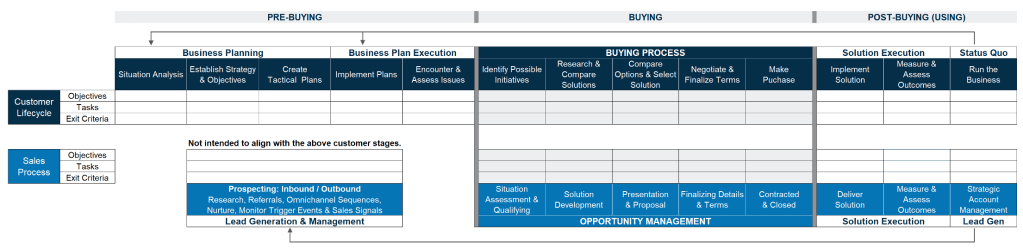

If you’re a regular reader you’ve seen this a few times. As a disclaimer, this is just one example of a customer lifecycle with a buying process included, and the corresponding sales process stages (with the exception of lead gen, which floats). It may or may not be accurate for your customers and company.

Process Reminder

Every process has stages with stage names, tasks to be performed in each stage, and exit criteria which must be completed to move forward to the next stage. This is shown in the above image, which also identifies phases, such as Pre-Buying, Buying, and Post-Buying.

Buying Process Exit Criteria Reminder

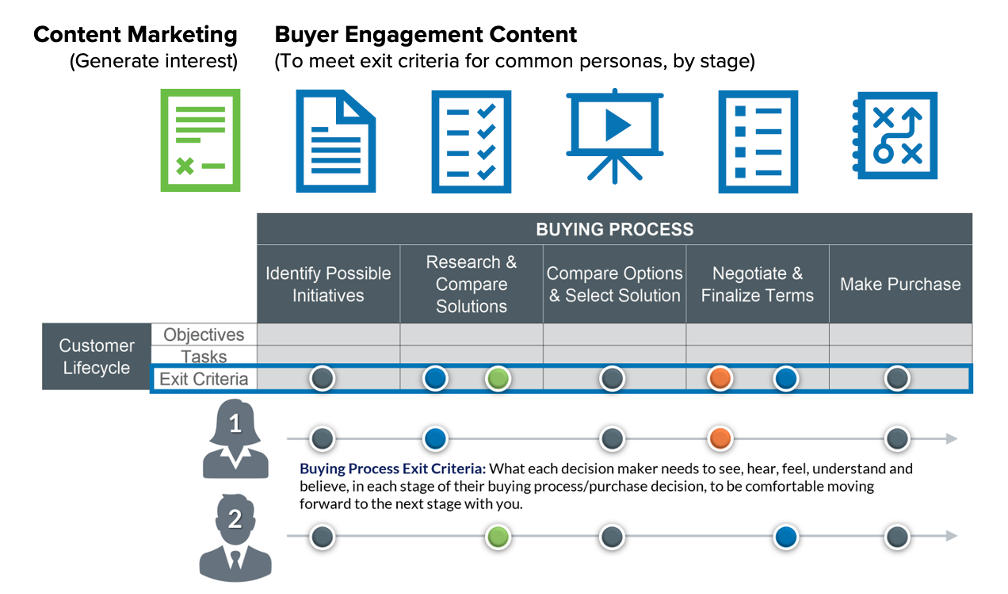

Buying Process Exit Criteria (BPEC) includes whatever each individual buyer (decision maker or influencer) needs to see, hear, feel, understand, and believe in each stage to be comfortable moving forward to the next stage with the salesperson.

While I rarely see it happen unless it’s taught, managing BPEC is the most effective way to manage a complex sales opportunity (multiple buyers). In Modern Sales Foundations, we teach sellers to:

- Uncover the exit criteria for each buyer in each stage.

- Clarify the criteria with each, to truly understand it.

- Deliver what each buyer needs to satisfy their exit criteria.

- Confirm that each buyer is satisfied and ready to proceed.

The Power of Process Documentation & Exit Criteria

A process is a lot like gravity. It exists whether or not you know about it, believe in it, or understand it. But without researching reality (buyer acumen/persona research) and how your buyers (and others like them) buy things and make purchase decisions, you are leaving a lot up to chance or luck.

For example, without knowing what your average, generic personas care about at each stage, you are left guessing at what collateral you need at each stage, by persona, that will generate interest (Content Marketing) to engage or answer their questions and satisfy their exit criteria throughout their buying journey (Buyer Engagement Content).

In addition, you also won’t have the data and insights to develop corresponding Sales Support Content and collateral, to support sellers in effectively moving opportunities through the pipeline – again, based on what your buyers care about. See the bottom portion of the above chart.

Now, for sellers, they must take it one step deeper. It’s great to have the Buyer Acumen and persona research with process documentation. But that is based on research and generic or average personas. Sellers must actively listen and engage with each decision maker and influencer to uncover and clarify their individual exit criteria — which may be different than the generic and include personal value drivers as well — and then satisfy those specific exit criteria and confirm the buyers’ satisfaction.

The Non-Linear Aspect of Process Management

I’ve seen all the charts from analysts and others that look like a second-grader’s scribbles attempting to communicate how confusing, winding, non-linear, and disjointed that the buying process is.

The Squiggle Journey

Artwork by yours truly. Amazing, no?

I think these charts are well-intended but misleading. Even in the squiggly images, and with all the complexity in the buying process, it eventually moves to the right. This is much like a view of the stock market performance. Take a close enough look at a small period in time, and it appears to be tanking, and investments don’t make sense. Pull back far enough and the market has consistently grown over time, through a series of ups and downs that ultimately have steadily risen.

In a similar vein, The Squiggle Journey, as I’ll call it, does progress through stages. It does this whether or not the buyers have an internally documented buying process or whether they are just a cohort of leaders who are exploring options and trying to make a good decision. The point is, whether or not their process is formalized, it’s still a process.

Here’s an example of what I mean.

The Squiggle Journey with Stages

For the example, I’ve used a simplified 4-stage journey of Awareness: Problem Identification, Interest: Solution Exploration, Consideration: Requirements Refinement, and Decision: Solution Selection. On either side you’ll see “Unaware” before they recognize a problem worth solving and “Usage” where they will implement and use what they purchased. Simplified, and hopefully clear and sensible.

It’s Not Really That Squiggly

The squiggly images are fun to make a point, but in reality, it’s more like several lines (representing the various decision makers) that move forward and backward as they progress to the right. Like the stock chart that moves up and down, as it moves to the right, where it ultimately goes up.

Here’s one example. I could make a dozen, but hopefully this gets the point across.

And now, to stop hand-drawing squiggly lines, let’s look at it another way. Here are the same four stages with 5 Buyers.

- The green Xs indicate what stage the buyer is currently in.

- The text indicates when the exit criteria (BPEC) has been satisfied for a buyer (the salesperson may or may not have purposefully done nor confirmed this).

- The blue-green box with the star indicates where the typical salesperson thinks they are in the process (newsflash: they are 40% correct).

This is a good representation of what commonly happens. The salesperson has two buyers (2 and 3) in Stage 2: Interest and thinks that’s where he (and the other buyers are). In reality, Buyers 1 and 5 have not had their exit criteria satisfied in Stage 1: Awareness, and Buyer 4 is ahead of the pack in Stage 3: Consideration.

This happens because most sellers (the average ones) do the same thing, the same way, each time, in each stage. They don’t pay attention to the fact that different buyers may not all have the same exit criteria in any given stage. The truth is that they could have the same criteria as others, or they may have entirely different exit criteria based on their role, goals, desired outcomes, and Value Drivers (Business, Experiential, Aspirational, and Personal – the last of which is very individualized).

Now let’s make it more interesting. Look at the image below. The top image is a repeat of the above (so you don’t have to scroll up) and the bottom image represents a change for Buyer 4, based on some new information she received that had altered her requirements and nudged her backward one stage (from Stage 3 Consideration to Stage 2: Interest).

This is not as big a deal as it might be otherwise, because Buyers 2 and 3 are still in that stage with Buyers 1 and 5 still lagging behind in Stage 1: Awareness. Still, the seller needs to meet the BPEC for Buyer 1 and 5 to move them forward to where the rest are and then meet all their various BPEC for Stage 2: Interest.

- Quick Question: Is this what your sellers are doing? Paying attention to this level? As a sales or enablement leader, it’s an important question to ask yourself.

Let’s look at another example. In this later-stage example, Buyers 1, 3, and 4 are in Stage 3: Consideration. Buyer 2 is in the final stage, ready to make a buying decision. Buyer 5 is lagging behind in Stage 2: Interest. The salesperson, who still isn’t managing individual exit criteria, thinks they’re in Stage 3. See the problem? This rep needs to implement a “No buyer left behind” rule.

Now let’s take a look at what happens next. Again, the top image is the same as above and the bottom reflects the changes.

A teammate in an earlier stage has created some doubt or Fear of Messing Up (FOMU) for Buyer 1, who was ready to make a decision (Stage 4), but has now slid back to the previous stage (Stage 3: Consideration), wanting more info and reassurance.

A requirement change in her department has nudged Buyer 3 from Stage 3: Consideration back to Stage 2: Interest.

The Salesperson? Yes, still sitting in Stage 3: Consideration, thinking that’s where they are.

One Last Disclaimer

Most buyers working in a buying committee are not professional buyers. They’ve decided to pursue an external solution, or have been tagged and “volun-told” to participate, or have a vested interest and want to be part of the committee. While it’s true that some buying committees have a formal process they follow or assistance from a procurement team, many are winging it, following whatever they or the lead buyer with the budget thinks is a good way to proceed. The variance is huge.

If you can guide them or get an agreed-upon Mutual Action Plan in place – wonderful. But even if not, and even if they are winging it, it still follows a general decision process that human go through, from left to right (with an acknowledgement that any buyer can backslide or have doubts, at any time). Yet, it’s still a process – and you (or your sellers) can manage it. Managing the individual BPEC is the key.

My Final Advice

Take-Aways

- Formalized or not, the buyers are going through a decision process (buying process).

- In a buying process, buyers can move both directions (forward and backward).

- Each buyer may have the same or different BPEC than the others.

- Buying Process Exit Criteria (BPEC) can change, and the buyer’s confidence or opinion or risk tolerance can change.

Sellers should always:

- Uncover the exit criteria for each buyer in each stage.

- Clarify the criteria with each, to truly understand it.

- Deliver what they need to satisfy their exit criteria.

- Confirm that the BPEC for each buyer is satisfied and they’re ready to proceed.

And as a general rule:

- Do: Keep track of where each buyer is and manage individuals to gain group consensus to move forward.

- Don’t: Barge ahead blindly, wearing your Hope Goggles, without ensuring all buyers are with you.

Closing Thoughts

So, even if it’s non-linear, the buying/selling processes can still be managed. By following the above advice, you still won’t win every deal (sorry), but you will radically reduce stalls and No Decisions.

Also, if you want to buy any squiggly line artwork, you know who to come to.

This post was originally published as a LinkedIn newsletter, which you can find here.

Previous

Next